For the Background of this post, do read my last one. This post is a result of the many frustrating times I spent listening government politicians, the media, and most other people attributing the causes of inflation to increasing of prices in the world market, in particular spiraling Oil prices.

The fundamental argument of Oil-induced inflation, was summarized in a recent editorial in the Daily Mirror:

Obviously, it is the inexorable skyrocketing of the oil prices in the world market – over which the government has no control - that have the ripple effect on prices of all goods and services. Increased fuel prices have its inevitable impact on electricity prices. The combined effect of price hikes in these two items, fuel and power, impact on all activities ranging from transport to production of various consumer items of food. The inevitable result is phenomenal increase in prices. [link : DailyMirror Editorial, March 21, 2008]The argument is elegantly simple. Oil prices rise. All goods are transported using vehicles, which uses oil, costs go up, so does the prices. It seems so reasonable, that the theory has many adherents. So much so, the Central Bankers in Sri Lanka (who now presides over an embarrassing 20% rate of inflation) help perpetuate this theory.

Now, I'm a great fan of peer education. So in my last post, I promised a sort of a for dummies-by-dummies guide on inflation. Looking back now, that was a silly promise to give. You can probably write a book on the subject. So what follows is a basic debunking of the oil-induced inflation myth, it's not unfortunately a complete dummies guide. But I will try to be as elaborate as possible.

The explanations may come across as being overly simplistic, and grossly inadequate. I accept both these charges. This is after all a dummies guide, and a blog post at that.

That thing called money.

As I discussed in my earlier post, Money has no value all by itself. It's just pieces of paper, what gives it value is that people use money to buy goods and services and because of that, there is a demand and therefore a value attached to it. Money also has a different value, than the number that's printed on it.

For example, like I said in my last post, I have a 20 Rupee Indian Note in my pocket. As you know, there is less acceptance (demand) for Indian rupees here in Sri Lanka, than in India. So the 20 Indian Rupee note I have is significantly less valuable here than it would be in India.

It's also true that what was a Rs.20 now in Sri Lanka is significantly less valuable than a Rs.20 in say, 1970.

First lesson in understanding inflation is perhaps realizing that money has different value attached to it than what's printed on the currency notes and thinking of inflation in terms of value of money rather than the prices of goods.

Do-It-Yourself Inflation experiment.

Literally speaking, printing money is quite simple. In Sri Lanka, it's printed in a factory (which I think is) in Biyagama. The Central Bank of a country has the control of much money is in the system, now that is not so simple to explain, but you'll have to trust me on that one. The point is, when I say "Printing Money" it doesn't mean literally printing notes, it refers to any way the Central Bank use to increase the money supply. Whenever you hear the phrases like , The Central bank has purchased Treasury Bills, the CB has lowered interest rates, it means the Central bank has put more money into to the system by increasing the money in circulation, expanding access to credit, so on. So in short, "money printing" is not just printing notes, it's any form of expansion of "money" in the system. Money, as you know, exists in many forms other than notes (credit, etc.) (updated - HT: ddm)

So, how is any of this relevant to inflation? Well, inflation is created by excessive money printing, which in turn is controlled by the central blank. So to put it bluntly, the Central Bank creates inflation. It's as simple as that.

Now, if you haven't heard of this before, this might come across as something between hallucinatory and laughable. So let me run through this thought-experiment I've developed.

Imagine that you are in grade 7. You and a friend of yours (let's call him Tom) want this really cool key-tag I have. I'm a cheeky little you-know-what, that I will only give it to the highest bidder. You have Rs.80 in your pocket, Tom has Rs.90. I start calling for bids at Rs.40. Both of you really like this key-tag.

The bidding starts: Tom starts biding at 50, You raise it to 60. Tom in turn raises the bid to 70. Now, you are in bit of a soup - you have only 10 Rupees left, but you really need Rs.5 of that to go home. If you don't use that 5 you'll have to walk your way home, and your mom would be very very annoyed. This Rs.5 is really valuable to you right now, so after thinking it over, you decide the to raise your bid to Rs. 75. Leaving Tom with Rs.15, to outbid you. But at this moment, there's a little twist in our tale.

Enter: The counterfeiter. Now (for no real reason, totally randomly) let's call this counterfeiter, Cabraal. Now Cabraal has this really cool laser printer which can print currency notes and he wants to test out some of his newly-printed stuff. So he walks over to you, and takes you to the side and hands you what appears to be two bills of Rs.10 notes, he says he's just helping out and everything is cool.

Suddenly, that Rs.5 you had with you doesn't seem too important anymore. The bidding starts again, Tom raises the bid to 80, you bid at 85. Again Tom retaliates by raising the bid to Rs.90, you raise the bid to Rs.95 and poor old Tom, not having the money to out-bid you, looses out and you get to buy the key-tag at Rs.95.

Think again as to what actually happened. The key-tag which would have sold at possibly Rs.80 (and a maximum of Rs.90 - all the money Tom had) was sold at Rs.95. The price increased simply because more money was injected into the process by counterfeiter Cabraal.

This is kind of what happens in our economy, when The Central Bank prints too much money without an increase in productive activity in the economy, all prices go up. This is inflation. It's a result of too much money chasing too few goods, we would eventually attach a smaller value to money and spend more of it, so prices 'sky rocket'.

In fact, most classical economists explicitly defined inflation as the growth of the money supply rather than the overall increase of prices.

Price of a particular item, like Oil, or Soap can increase (or decrease) due to all sorts of reasons and this may indeed contribute in recording a overall higher (or lower, with all other things being equal) value in the Consumer Price Index (which is used to measure inflation nowadays), but this is not the 'cause' of inflation. In fact general price increases are a result of inflation rather than it's cause.

So Why do they get it so wrong ?

If controlling inflation is so easy, Why do Central Banks like that of Sri Lanka and Zimbabwe get it so horribly wrong? Surely, Governor Cabraal and Co. know basic monetary economics? I certainly hope so. But the reason why certain central banks fail to control inflation is that governments (especially like ours) see printing money as a way to pay for their spending.

When you have a massive government set up like in Sri Lanka (100+ ministers and the obscenely large public sector), with a war, failing state enterprises and all other wasteful spending to finance, you end up having to tax, borrow when that's not enough - print money. This is why inflation is high in Sri Lanka.

But wait, why is this inflation thing so bad?

It might seem obvious, but it's a surprisingly good question. If prices of all things rise, then prices of whatever I sell must also be higher, so what's the big deal with inflation? Are we really worrying over nothing? Well, not exactly.

First of all, Inflation is a tax on everyone who holds money. Either in your wallet or a bank (savings/fixed deposit) account which pays less interest than the rate of inflation (which is the case in Sri Lanka). Every cent that you have in your bank and in your pocket right now is melting away as you read this. If you had Rs.100 in your savings account at 5% annual interest rate, and the annual inflation is 24% (pdf link) your Rs.100 at the end of the year is worth only Rs.81. You are literally being robbed of nearly 20% of your money.

Secondly, Incomes doesn't always keep up with the pace of inflation. So your purchasing power goes down. People with fixed incomes like pensioners are seeing their purchasing power plummet.

Thirdly, what makes free-market capitalism work is it's price system. Prices act as signal to producers, consumers and all actors of the market on what to buy, where to invest and how to allocate resources. High Inflation distorts this price signal (with an injection of money without productive activity) resulting in mal-investment, miss-allocation of resource and generally wrong economic decisions.

Additionally, inflation leads to an arbitrary distribution of wealth. When the Central Bank increases the money supply by say, lowering the interest on credit, those who get their hands on the credit first, generally benefit and those who don't, looses out. (Think of Tom in our thought-experiment)

Finally, high inflation creates uncertainty. If inflation is difficult to predict and volatile (a symptom of high inflation) that discourage productive economic activity. For example, a money lender may be reluctant to lend his money because he cannot predict if the interest he charges would be sufficient in face of volatile inflation.

Hmm, but can't the oil theory be also true?

The theory "Cost-Push" inflation, the idea that inflation is as a result of rising cost of things such as oil, was in fact quite a mainstream idea, about 30 years ago. Before Milton Friedman and others showed that inflation is always and everywhere a monetary phenomenon.

Without going into a theoretical argument on why this is not the case, let's say this hypothesis is true. Oil is the cause of (or the main contributor to) inflation.

What should we see? Surely,

1) All oil producing countries should have relatively low inflation. and,

2) All countries mostly importing their oil should have relatively higher inflation.

But none of these propositions are true. Iran, Russia and Venezuela three of the largest Oil producers have significantly higher inflation with Iran and Venezuela having close to 20% of inflation, much like Sri Lanka. On the other hand, countries which imports most (or all) of their oil consumption like New Zealand, Japan and Hong Kong are among the countries with lowest inflation.

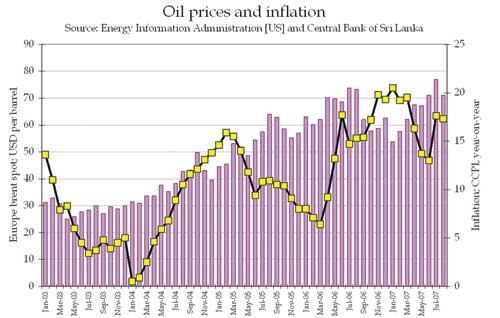

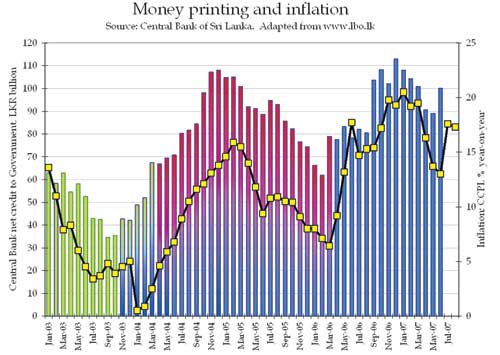

If that isn't proof enough, this graph from LBO/FT, showing the correlation between money printing and inflation and lack of a correlation between inflation and oil prices should really settle it.

So what can be done about this?

So what can be done about this?Sri Lankan economists offer two basic solutions. Both of which has to do with Central Bank Independence.

I'd say all solutions must include firing Ajith Nivard Cabraal from his post as governor of the Central Bank. If you are serious about Central Bank's independence you simply can't have the President's former campaign manager at it's helm.

The two dominant views on institutional reforms to central banking in Sri Lanka are the following:

- Bring in inflation-targeting legislation. This involves the parliament passing a law which mandates the Central Bank to stick to a particular level of inflation (say from 1-3%). Countries like New Zealand, Australia, Canada and Great Britain have enacted such legislation and it has proven to be relatively successful. Harsha De Silva, the well-known Sri Lankan economist is an advocate of this type of reform.

- A Currency Board arrangement. This involves pegging the SL rupee against a hard currency such as the US Dollar, which allows Sri Lanka to basically import the pegged currencies' inflation rate, in the case of the USD this would be 4% as opposed to the current 20+% inflation rate. Hong Kong has this type of arrangement with the US Dollar. LBO's Fuss-Budget and international monetary expert, Steve Hanke have recommended Sri Lanka follow a currency board, which we had till 1950 with relatively low inflation.

That's it for the dummies guide. It's been considerably longer than I wanted it to be, but I don't have time for a shorter post, hence the longer one. I Hope this has been helpful, I wish some of our politicians and newspaper editors can have a look at the actual causes of inflation rather than ranting on false, long-debunked theories.

Recommended Links :

- No Escape: Inflation is created in the Central Bank

- Sri Lanka : Slaying the Bogey of Inflation

- Pod Casts : Tyler Cowen on Monetary Policy Competing currencies, Gold Standard, and more. Also, Milton Friedman on Money (Both highly recommended)

8 comments:

Nice. Truth should be exposed to the ordinary man

Someone told me that investing in Central Bank bonds is a good idea. What do you think?

Deane: Thanks a lot for the post; explains a lot for people who dont have an econ background (like me :))

JJ: From what I know, the Govt Bonds at SL offer a worse rate than the FDs, even at the secondary market. Only thing is you can be sure that the govt will pay back the amount they borrowed. But I really don think this is a decision making factor (but for all you know, there WERE banks like Pramukha).

Money printing is not just printing new notes - cabraal will, as he often does, challenge you to show him a note with his signature on it. Even the Rs. 2k note has the signature of Mr. Sunil Mendis (i think). Anyway money printing, as you call it, is more accurately stated as expansionary monetary policy - that is Central Bank credit to the private sector and the govt. When there's more credit in the market, consumption and investment increase at a faster pace than supply - so naturally prices increase. You don't need to print a single note to have this effect.

LBO keeps harping about money printing in LK and more recently in the states - the latter refers to the cuts in interest rates to increase liquidity in credit markets that have tightened up in the recent past - not to the actual process of printing money. I personally feel that LBO in particular undermine their credibility by using such simplistic arguments.

ddm, right. Should have emphasized that more, will add a para (I vaugley tried).

I don't think LBO does the same mistake, when they say "print money" they do mean monetary expansion,like you say, not literally printing notes.

Nicely Done. But one thing, If Oil causes the CPI to record a higher figure, shouldn't it basically mean that it causes inflation?

One more, I see you haven't replied to my comment on JR :P

http://deaned.blogspot.com/2008/03/how-jr-ruined-everything.html

Maybe he is not so good matchang?

Java I'm not the best person to ask that mayte. Personally, I wouldn't.

Btw, Thanks to everyone.

and Andy:

Well I think the problem is measuring inflation with the CPI in the first place. Here's a good link on the subject.

But even when the CPI is taken as a measure of inflation, the point is Oil is still not the main 'cause' of the increase.

Just as I was writing this IMF put out this report which said much the same.

And will respond to your JR thing machang. :)

Post a Comment